After more than 20 years dedicated to improving SMEs, we can identify 3 powerful ways to increase the value of a company. Any potential buyer will want to know not only how much wealth the company has accumulated since its creation, but also, what its wealth creation potential is.

The Owner/Manager cannot rewrite history, so if they want to maximise the wealth of their business, they must focus on strategies to increase their capital base to provide the company with new prospects and to minimise risk.

1. INCREASing capital base

The first step should be to optimise the things in your existing operation that will directly affect profit. Imagine how much of an increase in sales would be required to have the same impact as a 5% saving on costs? To give you an example: with one of our clients we transformed a barely-break-even result into a 7% profit on sales by gaining 5% on purchases and increasing prices by 5%.

2. INNOVATing

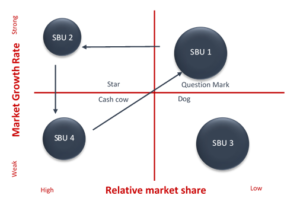

The future of the company will depend on emerging product/service offerings positioned in high potential markets. It therefore makes sense to have a diverse portfolio of strategic business units (SBUs) and to optimise the company’s resources. We find it useful to employ the Boston matrix here to help allocate resources to the different SBUs:

- Dogs generate little margin so there should be little or no investment in those activities

- Use the cash generated by ‘cash cows’ to fund promising innovations: ‘Question Marks’ that tomorrow will be ‘Stars’ and themselves future cash cows

- Use the available cash to maintain the leading market position of the Stars

- Milk the cash cows without major investment. In time, a cash cow will either exit the market or will be ripe for rejuvenation through innovation or technological breakthrough

Having no SBUs in growth markets will seriously jeopardise the future of the business!

3. MINIMISING THE RISK

This is about structuring the business so that it can operate with or without its Owner/Manager and ensuring that it is protected from any unusual loss of its client portfolio. There are many ways to do this: setting up a management committee, recruiting people with high-level skills, setting up defensive barriers, diluting customers that represent more than 15% of sales and securing contracts by obtaining commitments over more than one year.

These measures are of course, not exhaustive, but any Owner/Manager who works on these 3 aspects with appropriate resources for financing their growth will definitely create value. This will facilitate obtaining a loan for a potential buyer.